All Categories

Featured

Table of Contents

I paid into Social Safety for 26 years of substantial revenues when I was in the private sector. I do not want to return to work to obtain to 30 years of substantial revenues in order to avoid the windfall elimination arrangement decrease.

I am paying all of my costs presently yet will certainly do even more taking a trip when I am gathering Social Security. I assume I need to live up until about 84 to make waiting a good option.

If your Social Safety and security advantage is truly "fun cash," rather than the lifeline it works as for many people, maximizing your advantage may not be your top concern. Obtain all the information you can regarding the price and benefits of asserting at various ages prior to making your choice. Liz Weston, Licensed Financial Organizer, is a personal finance columnist for Questions might be sent out to her at 3940 Laurel Canyon Blvd., No.

Cash money value can build up and expand tax-deferred inside of your policy. It's important to note that exceptional policy car loans accumulate passion and decrease cash money value and the death benefit.

Nonetheless, if your cash value falls short to expand, you may need to pay higher costs to keep the policy effective. Plans may provide different alternatives for expanding your cash worth, so the attributing rate depends on what you select and exactly how those options perform. A fixed segment gains passion at a defined rate, which may transform with time with economic conditions.

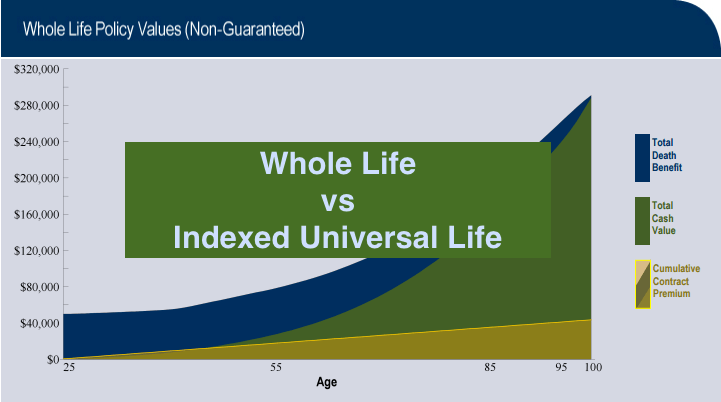

Neither sort of plan is necessarily much better than the various other - all of it boils down to your goals and strategy. Whole life plans may attract you if you favor predictability. You know specifically just how much you'll need to pay yearly, and you can see exactly how much money worth to anticipate in any type of given year.

Universal Vs Term Insurance

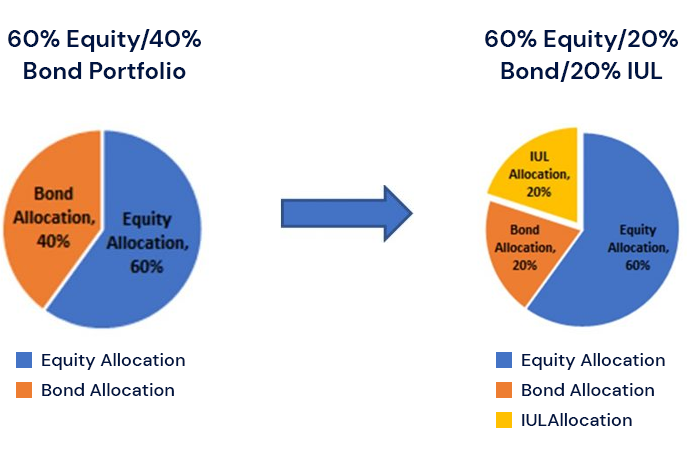

When evaluating life insurance policy needs, review your lasting objectives, your existing and future expenses, and your need for protection. Discuss your goals with your agent, and select the plan that works finest for you. * As long as necessary costs repayments are timely made. Indexed Universal Life is not a safety and security financial investment and is not a financial investment in the market.

Last year the S&P 500 was up 16%, but the IULs growth is covered at 12%. 0% floor, 12% prospective! These IULs disregard the existence of rewards.

Universal Benefits Insurance

Second, this 0%/ 12% video game is primarily a shop technique to make it seem like you always win, yet you don't. 21 of those were better than 12%, balancing nearly 22%.

If you need life insurance policy, acquire term, and invest the remainder. -Jeremy by means of Instagram.

Your existing internet browser might restrict that experience. You may be using an old web browser that's in need of support, or settings within your internet browser that are not suitable with our website.

Already making use of an upgraded web browser and still having problem? Please give us a phone call at for more support. Your current browser: Discovering ...

Equity Indexed Life Policy

You will certainly have to supply particular information concerning on your own and your way of living in order to get an indexed universal life insurance policy quote. The insurer might request information like your date of birth, sex, elevation, weight and whether you're a smoker. Smokers can expect to pay greater costs forever insurance coverage than non-smokers.

Guaranteed Universal Life Insurance Rates

If the policy you're checking out is traditionally underwritten, you'll require to complete a medical examination. This test includes meeting with a paraprofessional that will obtain a blood and urine example from you. Both samples will be examined for feasible health and wellness risks that can impact the kind of insurance coverage you can get.

Some aspects to consider consist of the amount of dependents you have, the amount of incomes are entering into your household and if you have expenditures like a home mortgage that you would desire life insurance to cover in case of your fatality. Indexed universal life insurance policy is one of the a lot more complicated kinds of life insurance currently readily available.

If you're searching for an easy-to-understand life insurance coverage plan, however, this may not be your finest option. Prudential Insurance Provider and Voya Financial are a few of the greatest suppliers of indexed global life insurance coverage. Voya is considered a top-tier carrier, according to LIMRA's second quarter 2014 Final Premium Reporting. While Prudential is a longstanding, highly valued insurance provider, having been in company for 140 years.

What Is A Guaranteed Universal Life Insurance Policy

On April 2, 2020, "A Vital Testimonial of Indexed Universal Life" was made available with different outlets, consisting of Joe Belth's blog site. Not remarkably, that piece generated substantial remarks and objection.

Some dismissed my comments as being "persuaded" from my time working for Northwestern Mutual as an office actuary from 1995 to 2005 "regular entire lifer" and "prejudiced versus" products such as IUL. There is no challenging that I helped Northwestern Mutual. I enjoyed my time there; I hold the company, its employees, its items, and its mutual ideology in prestige; and I'm grateful for all of the lessons I discovered while employed there.

I am a fee-only insurance coverage expert, and I have a fiduciary obligation to keep an eye out for the very best passions of my clients. Necessarily, I do not have a bias toward any type of type of product, and as a matter of fact if I find that IUL makes feeling for a client, after that I have an obligation to not only existing yet recommend that choice.

I always strive to put the very best foot forward for my clients, which implies utilizing designs that minimize or remove commission to the best level possible within that certain policy/product. That doesn't always mean recommending the policy with the cheapest compensation as insurance policy is much more difficult than just contrasting compensation (and sometimes with items like term or Assured Universal Life there simply is no payment adaptability).

Some recommended that my level of passion was clouding my judgement. I love the life insurance policy sector or at the very least what it can and ought to be (universal life insurance cash surrender value). And indeed, I have an unbelievable quantity of interest when it comes to wishing that the market does not obtain yet an additional shiner with extremely hopeful illustrations that set consumers up for disappointment or even worse

Iul Reviews

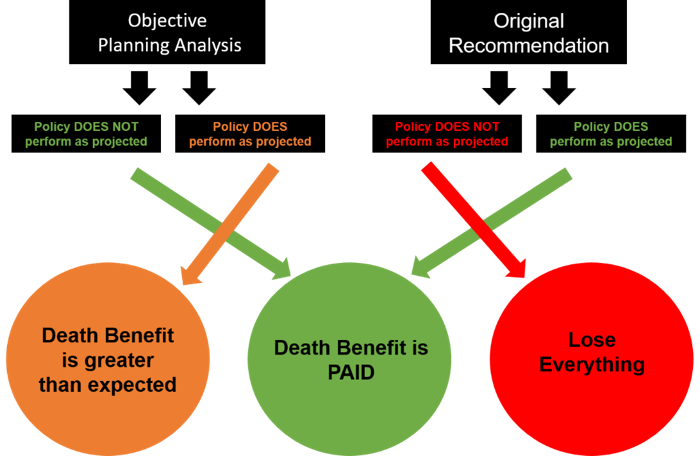

I may not be able to transform or conserve the industry from itself with regard to IUL products, and truthfully that's not my goal. I want to help my clients maximize worth and stay clear of crucial mistakes and there are consumers out there every day making poor decisions with respect to life insurance coverage and specifically IUL.

Some individuals misconstrued my criticism of IUL as a blanket endorsement of all things non-IUL. This might not be additionally from the fact. I would certainly not directly advise the large bulk of life insurance policy policies in the market for my clients, and it is rare to discover an existing UL or WL policy (or proposal) where the visibility of a fee-only insurance policy consultant would certainly not include substantial customer value.

Latest Posts

What Is The Difference Between Whole Life Insurance And Universal Life Insurance

Universal Term Life

Nationwide Iul Review