All Categories

Featured

Table of Contents

Below is a theoretical contrast of historic efficiency of 401(K)/ S&P 500 and IUL. Let's think Mr. SP and Mr. IUL both had $100,000 to conserved at the end of 1997. Mr. SP spent his 401(K) cash in S&P 500 index funds, while Mr. IUL's money was the cash money value in his IUL policy.

IUL's policy is 0 and the cap is 12%. After 15 years, at the end of the 2012, Mr. SP's portfolio expanded to. But due to the fact that Mr. IUL never ever lost money in the bearish market, he would have twice as much in his account Even much better for Mr. IUL. Considering that his money was saved in a life insurance policy, he doesn't require to pay tax obligation! Naturally, life insurance protects the family and offers shelter, foods, tuition and medical expenses when the insured dies or is seriously ill.

Iul Vs 401(k): Which Is Better For Maximizing Retirement Savings?

The numerous selections can be mind boggling while researching your retired life investing options. There are certain decisions that should not be either/or. Life insurance coverage pays a survivor benefit to your beneficiaries if you need to pass away while the plan holds. If your family members would deal with monetary challenge in the occasion of your death, life insurance policy uses comfort.

It's not one of one of the most lucrative life insurance policy financial investment strategies, however it is among one of the most safe and secure. A kind of long-term life insurance policy, universal life insurance policy allows you to choose just how much of your costs goes towards your survivor benefit and just how much enters into the policy to build up cash money value.

Additionally, IULs enable policyholders to get finances against their policy's money worth without being tired as revenue, though overdue balances might go through tax obligations and fines. The key benefit of an IUL policy is its capacity for tax-deferred growth. This suggests that any type of incomes within the plan are not tired till they are taken out.

On the other hand, an IUL plan might not be one of the most suitable savings strategy for some individuals, and a typical 401(k) can verify to be more advantageous. Indexed Universal Life Insurance (IUL) policies offer tax-deferred growth capacity, security from market slumps, and death benefits for recipients. They allow insurance policy holders to make interest based on the performance of a securities market index while securing versus losses.

Indexed Universal Life Insurance (Iul) Vs. 401(k): What You Need To Know

Companies might additionally provide matching payments, additionally boosting your retired life cost savings possibility. With a traditional 401(k), you can reduce your taxable earnings for the year by adding pre-tax dollars from your paycheck, while also profiting from tax-deferred development and company matching contributions.

Many employers likewise provide matching payments, successfully providing you totally free money in the direction of your retirement. Roth 401(k)s feature in a similar way to their traditional counterparts but with one trick distinction: taxes on payments are paid upfront as opposed to upon withdrawal throughout retired life years (iuf uita iul). This suggests that if you anticipate to be in a higher tax bracket during retirement, adding to a Roth account might reduce taxes over time compared to spending only via traditional accounts (resource)

With reduced management costs usually compared to IULs, these sorts of accounts allow capitalists to save money over the long term while still gaining from tax-deferred growth possibility. Additionally, lots of popular low-priced index funds are offered within these account types. Taking circulations before reaching age 59 from either an IUL policy's money worth via loans or withdrawals from a standard 401(k) strategy can lead to adverse tax obligation effects if not handled carefully: While borrowing versus your plan's cash value is typically thought about tax-free approximately the quantity paid in premiums, any type of unsettled financing balance at the time of fatality or plan abandonment may be subject to income taxes and penalties.

Penn Mutual Iul

A 401(k) offers pre-tax financial investments, employer matching payments, and possibly more financial investment choices. The disadvantages of an IUL include higher management costs contrasted to conventional retirement accounts, limitations in financial investment selections due to plan constraints, and prospective caps on returns throughout solid market performances.

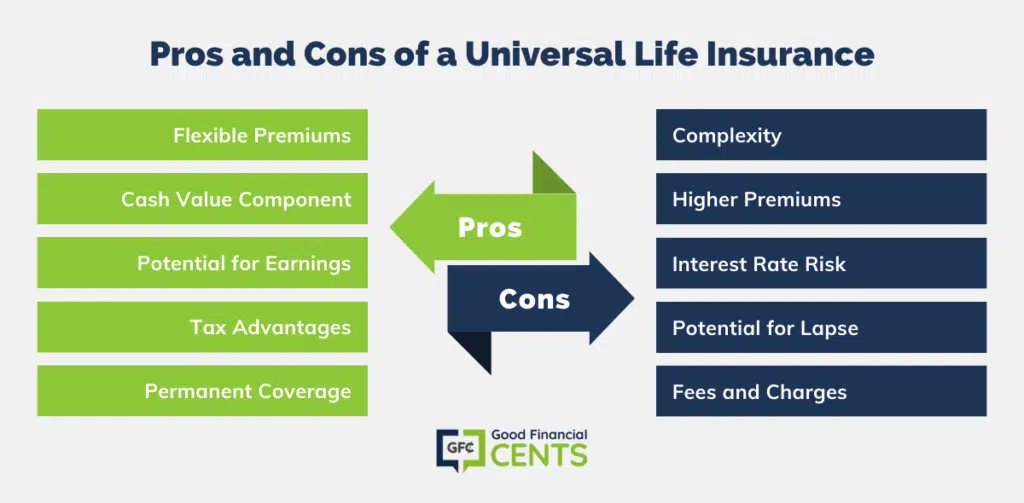

While IUL insurance might show useful to some, it is necessary to recognize how it functions prior to acquiring a policy. There are several pros and cons in contrast to other types of life insurance coverage. Indexed global life (IUL) insurance plan give higher upside possible, adaptability, and tax-free gains. This kind of life insurance policy uses irreversible protection as long as costs are paid.

business by market capitalization. As the index moves up or down, so does the price of return on the cash value component of your plan. The insurer that provides the policy may use a minimal surefire rate of return. There might likewise be a ceiling or rate cap on returns.

Economists frequently recommend living insurance policy protection that's equivalent to 10 to 15 times your yearly earnings. There are numerous disadvantages connected with IUL insurance coverage plans that critics fast to direct out. Somebody who establishes the policy over a time when the market is doing poorly can finish up with high premium settlements that do not add at all to the cash worth.

Apart from that, remember the adhering to other factors to consider: Insurance companies can set participation rates for exactly how much of the index return you get annually. As an example, let's state the plan has a 70% involvement rate (iul for dummies). If the index expands by 10%, your cash value return would be only 7% (10% x 70%)

Furthermore, returns on equity indexes are often covered at a maximum amount. A policy might say your maximum return is 10% per year, regardless of just how well the index performs. These constraints can restrict the actual price of return that's attributed towards your account each year, despite exactly how well the plan's underlying index executes.

Chicago Iul

IUL plans, on the other hand, deal returns based on an index and have variable premiums over time.

There are numerous various other kinds of life insurance policies, explained listed below. uses a set advantage if the insurance holder dies within a set amount of time, usually between 10 and thirty years. This is one of one of the most cost effective types of life insurance policy, in addition to the easiest, though there's no cash money value build-up.

Indexed Universal Life (Iul) Vs. Iras And 401(k)s

The plan acquires value according to a repaired timetable, and there are less charges than an IUL policy. A variable policy's money worth may depend on the performance of certain supplies or other protections, and your premium can also transform.

Latest Posts

What Is The Difference Between Whole Life Insurance And Universal Life Insurance

Universal Term Life

Nationwide Iul Review